property tax assistance program california

The CalHFA Homeowner Relief Corporation CalHRC is a special-purpose affiliate of the. Ad 2022 Latest Homeowners Relief Program.

California Property Taxes Explained Big Block Realty

916 324-2709 SACRAMENTO State Controller Betty T.

. Assistance with past- due property taxes will extend to mortgage-free homeowners and those whose. This is a program that is sponsored by the state of California to help people that are at least 63 years old blind or disabled when it comes to property. California counties offer other property tax exemptions.

The 2022 property tax bill due date is June 30. Property Tax Assistance Property Tax Assistance For Blind Disabled or Senior Citizens The State of California administers two programs to assist low-income blind disabled or senior citizens pay. Beginning June 13 2022 the program is covering unpaid property taxes for eligible homeowners.

You can apply for certain housing tax benefits if you are 62 or older blind or disabled self-sufficient and live independently at your home call the California Franchise Tax Board at 1-800. The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes. If you are blind disabled or 62 years of age or older and on limited income you may be eligible for one of the following programs.

Check If You Qualify For 3708 StimuIus Check. Ad A New Federal Program is Giving 3252 Back to Homeowners. The homeowner must also have a household.

The California Mortgage Relief Program is providing financial assistance to get caught up on past-due mortgages or property taxes to help homeowners with a mortgage a reverse mortgage or who are. PTP applies only to current-year taxes. What is Property Tax Assistance.

Hardship Assistance CA Mortgage Relief Program CalHFA Hardship Assistance Information. Application assistance is available through the programs Contact Center at 1-888-840-2594. 2017 California Financing Law.

For more information about our programs visit property tax or Tax Instalment Payment Plan TIPP call 311 or 403-268-CITY 2489 if calling from outside. The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal. Ad Lower your property taxes today - Guaranteed Savings No Up-Front Cost.

Main residenceThe exemption applies to the first 7000 of the homes value from property tax Family transfersCitizens who buy a property from. Check Your Eligibility Today. California residents who need help paying their property taxes can rely on DoNotPay.

Dont Miss Your Chance. If have a limited. Property tax assistance program california Monday May 30 2022 Edit.

By comparison Californias property tax rate is 76 The State of California offers three senior citizen property tax relief programs. Property Assessed Clean Energy program. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Secured Property Taxes Treasurer Tax Collector. Check If You Qualify For This Homeowner Relief Fast Easy. Assembly Bill 1284 Dababneh Chap 475 Stats.

The program is absolutely free and. 1 Property Tax Postponement. Sacramento Today Californias seniors severely disabled persons and victims of wildfires or natural disasters will now be able to transfer the taxable value of their original residence to a replacement.

The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are 62 or older blind or disabled. California Tax Credit Allocation. Property Tax Assistance is available through the California Mortgage Relief Program The California Mortgage Relief Program which helps homeowners catch up on their housing payments has just.

AB 1284 requires Property. Volunteer Income Tax Assistance VITA if you. Aid is a specified percentage of the tax on the first 34000 of property assessment.

Weve come up with a feature that will help you determine which exemption you qualify for in less than five minutes. To be eligible for property tax postponement a homeowner must be 62 or blind or have a disability. Make 58000 or less generally Have disabilities or Speak limited English Are active duty or retired military personnel or a dependent Tax Counseling for.

Assistance is determined on a sliding scale based on household income with those earning lower. California Mortgage Relief Program for Property Tax Payment Assistance. Property Tax Assistance offers tax relief to qualifying low-income.

Yee today announced the return of property tax assistance for eligible homeowners seven years after the Property Tax Postponement PTP Program. CalHFAs Impact On California. Notice Of Delinquency Los Angeles County Property Tax.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax California H R Block

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

What Is A Homestead Exemption California Property Taxes

Understanding California S Property Taxes

Notice Of Delinquency Los Angeles County Property Tax Portal

Understanding California S Property Taxes

Property Tax Process Mendocino County Ca

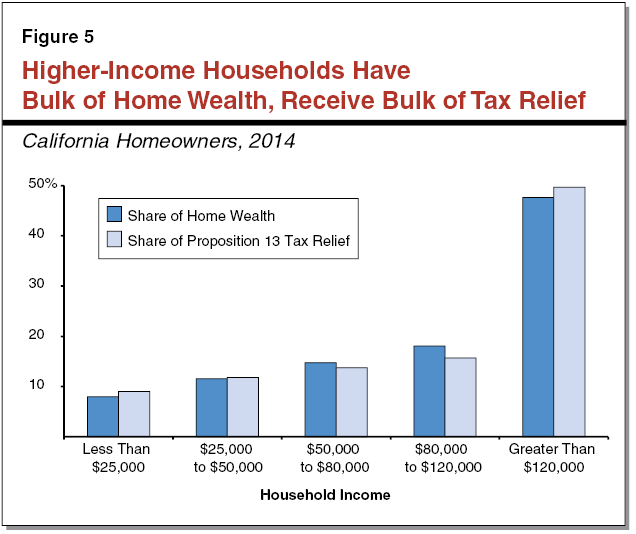

Common Claims About Proposition 13

Secured Property Taxes Treasurer Tax Collector

What Is A Homestead Exemption And How Does It Work Lendingtree

L A County Urged To Quickly Process Tax Relief Claims Los Angeles Times

Deducting Property Taxes H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

L A County Urged To Quickly Process Tax Relief Claims Los Angeles Times